Going public: SPACs offer a capital raising alternative for private companies

How a SPAC works

Typically, investors – or sponsors – with expertise in a certain industry form SPACs to pursue deals within that industry. A SPAC has no other real purpose; it does not maintain the business operations of a private equity or other investment firm, and all funds raised are earmarked to complete the intended acquisitions. Importantly, a SPAC has roughly a two-year time frame to complete an acquisition or face liquidation, in which case all proceeds would be returned to investors.

So, what does that mean for management teams interested in raising capital? It means that there is alternative route to an IPO that will enable them to access the public markets. Compared to a traditional M&A transaction, a SPAC process can add up to 20% to the sales price. When the process is complete, the management team will likely be retained to lead the surviving public entity. Moreover, SPACs give business owners a much quicker IPO process under an experienced partner while lessening any market sentiment volatility that could impact the pricing of a traditional IPO.

The growth of SPACs

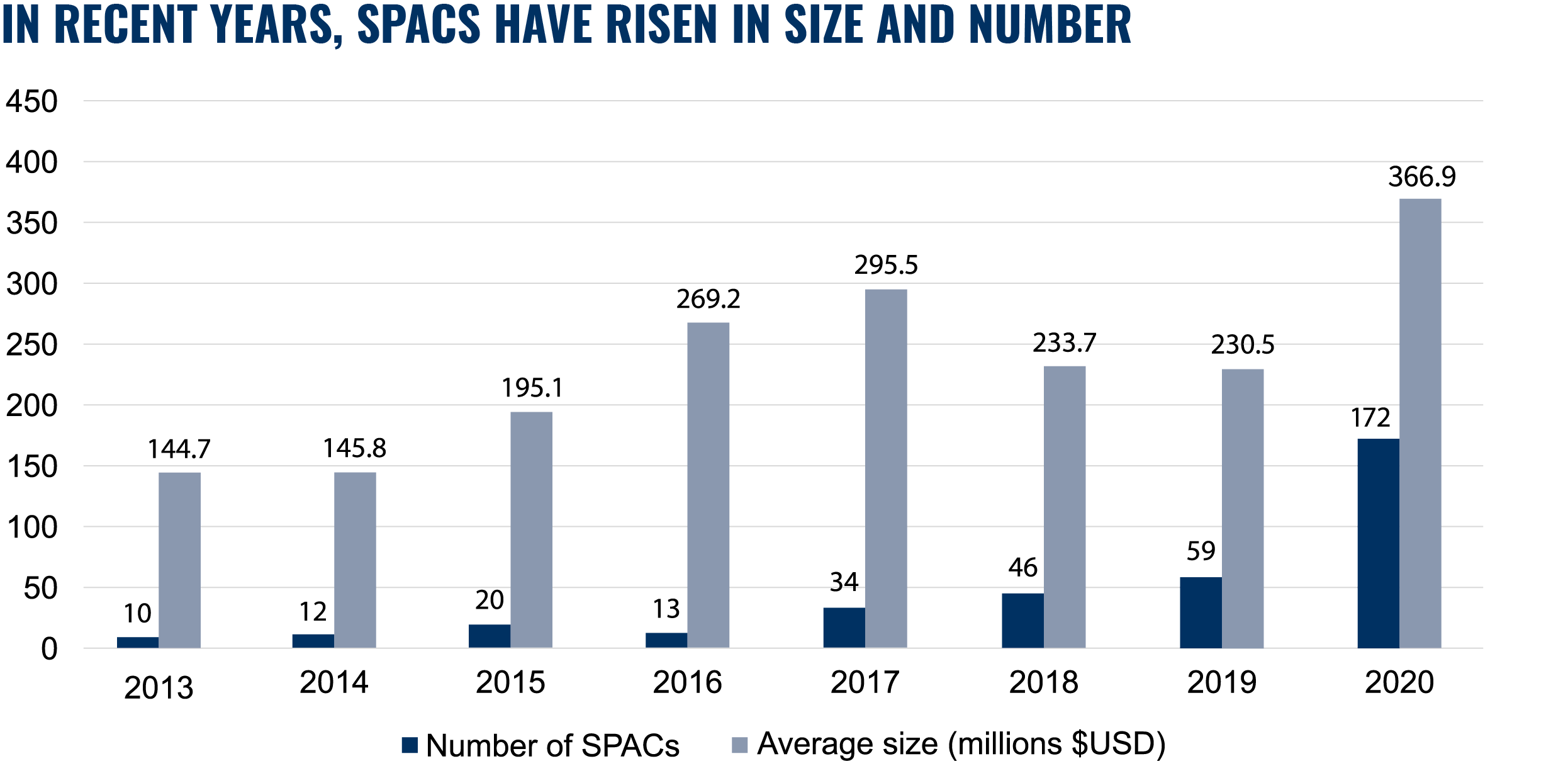

SPACs have grown significantly in both number and size over the past seven years, raising billions of dollars.

The future of SPACs

It’s likely that, for the foreseeable future, SPACs will remain a viable alternative to the traditional IPO. As access to capital continues to be an issue for private companies, and while investors look to put their dry powder to work, SPACs are perceived to be an important new home for both groups.

While a key benefit of raising capital through a SPAC is its advantageous terms, the decision to utilize a SPAC is a complex one that requires significant analysis. Contact our team or your trusted advisors for help identifying your best path forward.

Contact

Claudine M. Cohen, Managing Principal, Transactions & Turnaround Advisory

646.625.5717

Cindy McLoughlin, CPA, Managing Partner, Consumer, Hospitality, and Manufacturing Industries

516.336.5510

Cindy McLoughlin

Claudine Cohen

Contact

Let’s start a conversation about your company’s strategic goals and vision for the future.

Please fill all required fields*

Please verify your information and check to see if all require fields have been filled in.

SPACs: Alternative to Traditional IPO

Going Public: SPACs Offer a Capital Raising Alternative For Private Companies

Going Public as a SPAC Target Company: What to Consider and How to Prepare

Phases in the Lifecycle of a SPAC

Post-SPAC Transaction: Challenges and Benefits of Operating as a Public Company