Opportunity Zones Can Provide Investors with Significant Tax Benefits

Making a difference in distressed communities, CohnReznick has been on the cutting edge of innovative community development for more than 30 years. Whether it is working within tax credit programs, helping shape policy at federal and state levels, or collaborating with state and local economic development programs, CohnReznick has helped lead the growth and sophistication of the community development industry. Since the implementation of the affordable housing tax credits in 1986, subsequent tax credit programs, and now through the unique approach of Opportunity Zones, CohnReznick continues to serve investors, developers, governmental entities and other stakeholders to help communities reach their full potential.

The Potential of Impact Investing

Signed into law as part of The Tax Cuts and Jobs Act (2017), new Internal Revenue Code sections 1400Z-1 and 1400Z-2 provide for a new and dynamic community development program, known as Opportunity Zones. With trillions of dollars of unrealized capital gains built up in investments across the United States, the Opportunity Zone program provides a new federal income tax incentive for investors who choose to re-invest otherwise immediately taxable gains into Qualified Opportunity Funds (QOF). These QOFs are dedicated to investing in government-designated opportunity zones.

By stimulating both individual and corporate investment in low-income communities within these designated zones across the U.S. and its territories, it is anticipated that the resulting fund management platform and capital formation created by this new law will be significant.

OPPORTUNITY ZONE OVERVIEW

Opportunity Zones are designated census tracts that have been approved by the federal and state governments. There are currently more than 8,700 Opportunity Zones across all states, territories and the District of Columbia, in both rural and urban locations. (CohnReznick has published an interactive map with a searchable address feature to indicate whether specific properties are in a Qualified Opportunity Zone.

The purpose of this new federal income tax incentive is to encourage new investment in identified economically depressed localities. Identified as “Qualified Opportunity Zones,” this new designation is subject to a series of complex tax rules.

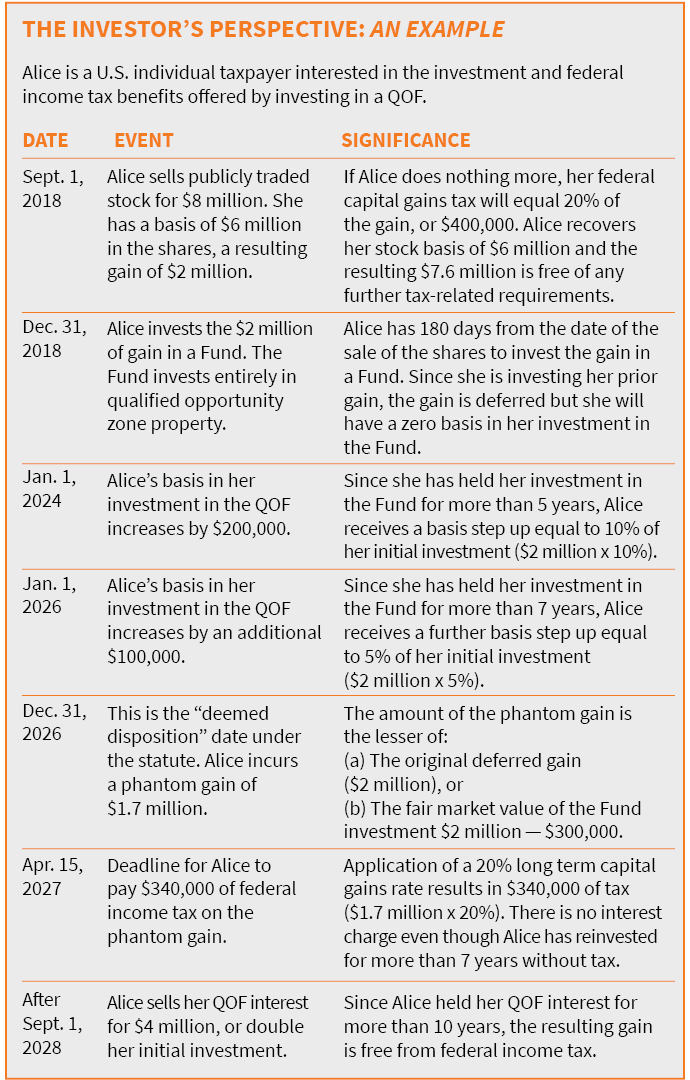

Investors can reinvest their gains from sales of stock and other types of capital assets into a QOF, such as works of art (including capital gains and so-called “section 1231 gains” from the sale of income producing rental real estate) and, as a result, take advantage of three distinct federal income tax benefits:

- Deferral of the federal income tax on the otherwise realized capital gain by investing the “gain dollars” into a QOF;

- Receive a partial basis “step-up” for the investment for the QOF. The 5-year and 7-year holding periods are measured by and between the date of acquisition of the QOF investment, and December 31, 2026;

- Permanent exclusion of the capital gains arising from any increase in value and the sale or exchange of the investment in the QOF from federal income tax, if the investment is held for at least 10 years.

HOW OPPORTUNITY ZONE INVESTMENTS WORK

To qualify for the tax benefit, an investment in an Opportunity Zone must be made through a QOF. The QOF must be organized under state law, either as a partnership or a corporation.

Investors contribute money equal to their capital gain realized within the past 180 days (but only the cash representing the actual gain portion; not the investors’ return of basis).

There is no dollar limit on the amount of capital gain an investor can contribute to a QOF.

The Fund then invests this capital by buying “qualified opportunity zone property,” which generally may include real estate and many types of operating businesses, provided they are in the Opportunity Zone.

As safeguards, the QOF:

- Must invest at least 90% of its assets in qualifying assets;

- Cannot acquire qualified opportunity zone property from a related party;

- Must spend at least as much as the acquisition price (if the qualified opportunity zone property is real estate), on substantially improving the property within a 30-month window period.

However, the related party and substantial improvement safeguards are often misunderstood, particularly in the context of qualified opportunity zone real estate owned prior to January 1, 2018. In these circumstances, achieving the tax benefits of the opportunity zone program will require careful structuring and analysis, and qualifying real estate projects will likely be new construction or involve substantial renovation.

OBTAINING THE TAX SAVINGS

Because the investor contributes funds that represent deferred capital gains, the investor starts with a tax basis of zero for his or her investment in the Fund. Upon the satisfaction of a 5-year year holding period, the statute provides for the investor to have a tax basis in the QOF investment equal to 10% of the original amount of the investor’s capital gain, and, upon holding the investment for an additional two years (seven years in all), the investor receives an additional 5% increase, for a total “free basis” (correspondingly, a reduction of deferred gain) equal to 15% of the original amount of the investor’s capital gain. The 5-year and 7-year holding periods are measured by and between the investor’s date of acquisition of the QOF investment and December 31, 2026.

If the QOF investment is not disposed of prior to December 31, 2026, the investor is treated as selling his or her interest in the QOF in a taxable transaction on December 31, 2026, for an amount realized equal to the lesser of: (a) the original deferred gain, or (b) the fair market value of the investor’s interest in the QOF. Federal income tax on the original deferred gain (reduced by any “free tax basis”) will be due and payable on or before April 15, 2027.

If the investor holds his or her interest in a QOF for 10 years or more, the investor is permanently exempt from paying federal capital gains tax on any gain realized from an increase in value of the investment during the Opportunity Zone Fund holding period recognized through the sale of his or her Fund investment.

To learn more about Opportunity Zones, contact:

Ira Weinstein, Managing Principal, Real Estate, Cannabis

Ira Weinstein

Contact

Let’s start a conversation about your company’s strategic goals and vision for the future.

Please fill all required fields*

Please verify your information and check to see if all require fields have been filled in.

Any advice contained in this communication, including attachments and enclosures, is not intended as a thorough, in-depth analysis of specific issues. Nor is it sufficient to avoid tax-related penalties. This has been prepared for information purposes and general guidance only and does not constitute legal or professional advice. You should not act upon the information contained in this publication without obtaining specific professional advice specific to, among other things, your individual facts, circumstances and jurisdiction. No representation or warranty (express or implied) is made as to the accuracy or completeness of the information contained in this publication, and CohnReznick LLP, its partners, employees and agents accept no liability, and disclaim all responsibility, for the consequences of you or anyone else acting, or refraining to act, in reliance on the information contained in this publication or for any decision based on it.