Our solutions are tailored to each client’s strategic business drivers, technologies, corporate structure, and culture.

How connected are interest rates and multifamily cap rates?

A look at multifamily cap rate trends during economic turbulence.

It is no secret that capitalization (cap) rates for multifamily properties have increased since the peak of the market in early 2022, prior to the central bank’s increase in interest rates. While interest rate increases are a main factor in increasing cap rates, other factors also contribute, such as supply, demand, rising expenses, demographic trends, and investor expectations.

To measure the impact interest rates have on cap rates, we looked at cap rate trends after historical interest rate increases and analyzed multifamily cap rate trends in each region over the past three years.

Data analysis

Looking back at the history of more recent fed rate hikes, the federal funds rate increased 400 basis points from 1.25% to 5.25% between June 2004 and June 2006. Comparatively, national multifamily cap rates decreased by 90 basis points from 7.2% to 6.3% during that time period. The next time the U.S. experienced a significant rise in interest rates was from March 2022 to July 2023, in an effort to combat rising inflation. In 2024, rising interest rates have led to increasing cap rates, although at a rate significantly below interest rate increases.

We analyzed cap rate trends over the past three years nationally, as well as in 48 states and the District of Columbia. The data is as reported by CoStar for multifamily properties with 10 or more units.

We found that between 2021 and 2022, only three of the 49 geographies showed increases in cap rates, while the remaining 46 showed decreases. This trend reversed between 2022 and 2023, with only five showing decreases and 44 showing increases.

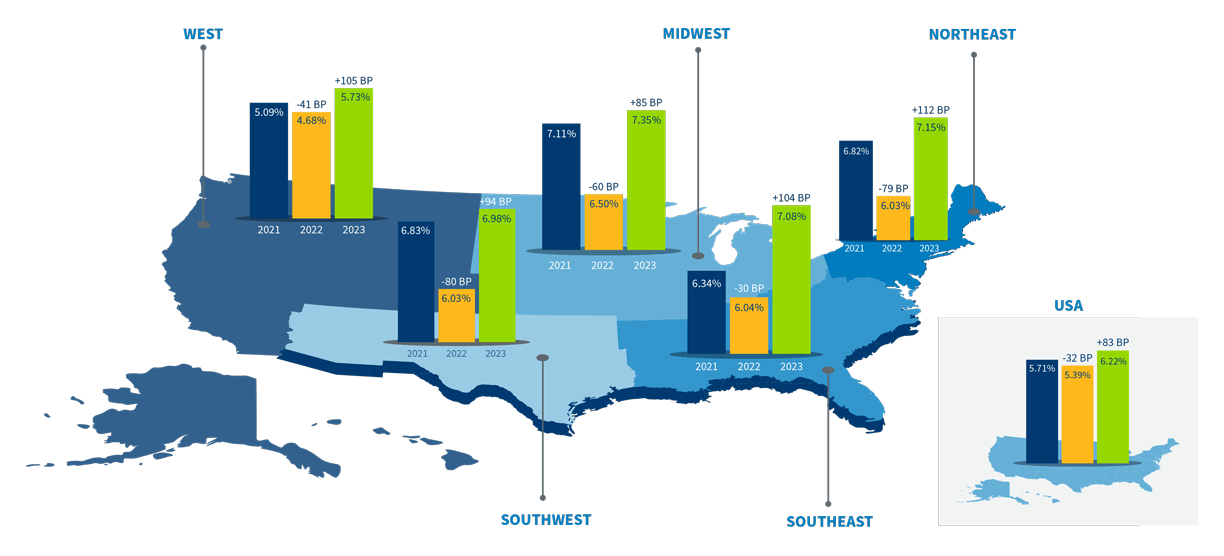

The following map illustrates multifamily cap rate trends regionally.

Created by CohnReznick using CoStar data

Average regional increases in cap rates between 2022 and 2023 ranged from 85 to 112 basis points, with the Midwest experiencing increases on the low end of the range and the Northeast on the high end. National data indicates a 83-basis-point increase in cap rates between 2022 and 2023, with an additional increase of 29 basis points in 2024 as of March 15. Along the same line, investor surveys from across the industry indicate increases of 50 to 70 basis points nationally between 2022 and 2023 as well as the expectation for cap rates to continue increasing over the next six months.

What do these numbers mean for industry participants?

Overall Cap Rates (OAR) have increased in most markets by 50 to 200 basis points since 2022, causing the multifamily investment market to slow. However, this increase was at a much slower pace as compared to the Fed Rate hike over the past 18 months. Real estate tends to lag the capital markets, given liquidity issues, so this isn’t necessarily strange. If properties are advertised for sale at capitalization rates significantly lower than interest rates, there will naturally be a more limited buyer pool as caused by companies and individuals being “priced out” due to expensive debt, hampering the investment sales market. This is a result of sellers who may be unwilling to reprice assets and accept lower bids, especially if their property has lower-interest debt, which is considered an asset as caused by the rising interest rates. Eventually, assuming interest rates stay high, cap rates will likely continue to rise as sellers finally acquiesce to the disconnect between interest rates and sales prices, and as the cost of capital aggravates operating expenses to a degree that decreases net operating income.

The 2023 and 2024 multifamily market is showing a high level of new supply, causing limited rent growth and an increase in vacancy, all of which is putting downward pressure on property prices. Interest rate stability could drive transaction volume in the national multifamily market, with transaction volume in 2024 expected to return to pre-pandemic levels (although below the volume experienced in 2021 and 2022).

The Consumer Price Index rose by 3.5% in March 2024 compared to the previous year, exceeding February’s 3.2% rate, as reported by the U.S. Bureau of Labor Statistics.

Elevated inflation levels during the first quarter of 2024 have tempered expectations for interest rate cuts this year, as reflected in the CME FedWatch Tool as of mid-April 2024:

- Earlier predictions at the beginning of the year suggested rate cuts starting as early as March, but the current consensus points to the Federal Reserve implementing its first federal-funds rate reduction in September, per a Morningstar analysis. Bond traders are now predicting a reduction in the funds rate to a target range of 5.00%-5.25%, with a 46% likelihood, compared to a 32% chance of rates staying unchanged and a 20% probability of a 50-basis-point cut.

- Forecasts for the number of rate cuts in 2024 have also been revised significantly downward, from an initial expectation of five cuts starting in March to just two cuts by year-end. Bond traders estimate a more than 30% chance that only one rate cut will occur in 2024.

While lower interest rates are expected to marginally reduce multifamily cap rates, they are not anticipated to return cap rates to the levels observed in 2021 anytime soon.

The data illustrates that there is a correlation between interest rates and multifamily cap rates. However, cap rates have not risen to the same extent as interest rates given the significance of other factors impacting multifamily properties, such as supply and demand, rent growth and vacancy, cost of operating expenses, demographic trends, and investor expectations. In the absence of transactional data, appraisers should perhaps temper their forecasts in consideration of all elements that impact sales prices and cap rates.

Contact our team with any questions about valuation or if you are interested in having an appraisal or market study completed.

Lauren Migliore

Andrew Lines

Contact

Let’s start a conversation about your company’s strategic goals and vision for the future.

Please fill all required fields*

Please verify your information and check to see if all require fields have been filled in.