Our solutions are tailored to each client’s strategic business drivers, technologies, corporate structure, and culture.

Life sciences companies: Offsetting payroll taxes with R&D tax credits

Life sciences companies should review their tax positions to determine the appropriate way to utilize credits to maximize tax savings.

Life sciences companies have experienced exponential growth through advancements in technology, scientific discoveries, and continued research and development. Countless new companies are seizing growth opportunities in the space and contributing to a booming industry by making significant advancements in biomedicine and biotechnology. Life sciences companies invest billions annually in designing new drugs, medical devices, and testing methods. Despite these costly and time-consuming efforts, a significant number of products never reach commercial production. Many companies offset their significant R&D spend by claiming the R&D tax credit.

Activities qualifying toward the R&D tax credit include:

- Designing new drugs, compounds or formulas

- Innovating new applications for existing drugs, new drug delivery methods

- Conducting FDA qualification, validation, and clinical testing during Phases I-IV clinical trials

- Establishing new factory or production lines using new technology or new manufacturing techniques including hardware and software development

- Developing new assays and testing methods or protocols

- Formulating new reagents and testing devices

- Improving yield, reaction times, or shelf life

- Creating cross-functional process improvements to enhance operational efficiency

R&D payroll tax offset

Furthermore, new or pre-revenue companies can benefit from the R&D credit as an offset against payroll taxes. Under IRC Section 41(h), a “qualified small business” (QSB), can elect to convert their federal R&D income tax credit to a credit against the employer’s share of FICA payroll taxes. Specifically, the PATH Act allows the R&D tax credit to be applied against the employer’s Social Security and Medicare tax liability (payroll taxes calculated at 6.2% and 1.45% of subject wages, respectively). A QSB is defined under Internal Revenue Code Section 41(h)(3) as a trade or business that:

- Is no more than five years past the period for which it had no gross receipts

- Has gross receipts for the election year of less than $5 million

The Inflation Reduction Act (IRA), effective for tax years beginning on or after Jan. 1, 2023, increased the annual payroll offset limit for the R&D tax credit from $250,000 to $500,000. In addition, qualified small businesses can apply the R&D tax credit payroll offset against the employer’s 7.65% combined FICA payroll tax liability.

Timing of the payroll tax offset

- To claim the payroll tax credit, the R&D credit must be calculated on a taxpayer’s federal income tax return with an election designating some or all of the credit to offset payroll taxes when the income tax return is originally and timely filed.

- The payroll tax credit is available on a quarterly basis starting in the first calendar quarter after the taxpayer files their federal income tax return.

- For example, if a QSB taxpayer made the payroll tax credit election and filed their return on March 1, 2025, the earliest quarter where the payroll tax offset could be applied would be the quarter ending June 30, 2025.

Case study

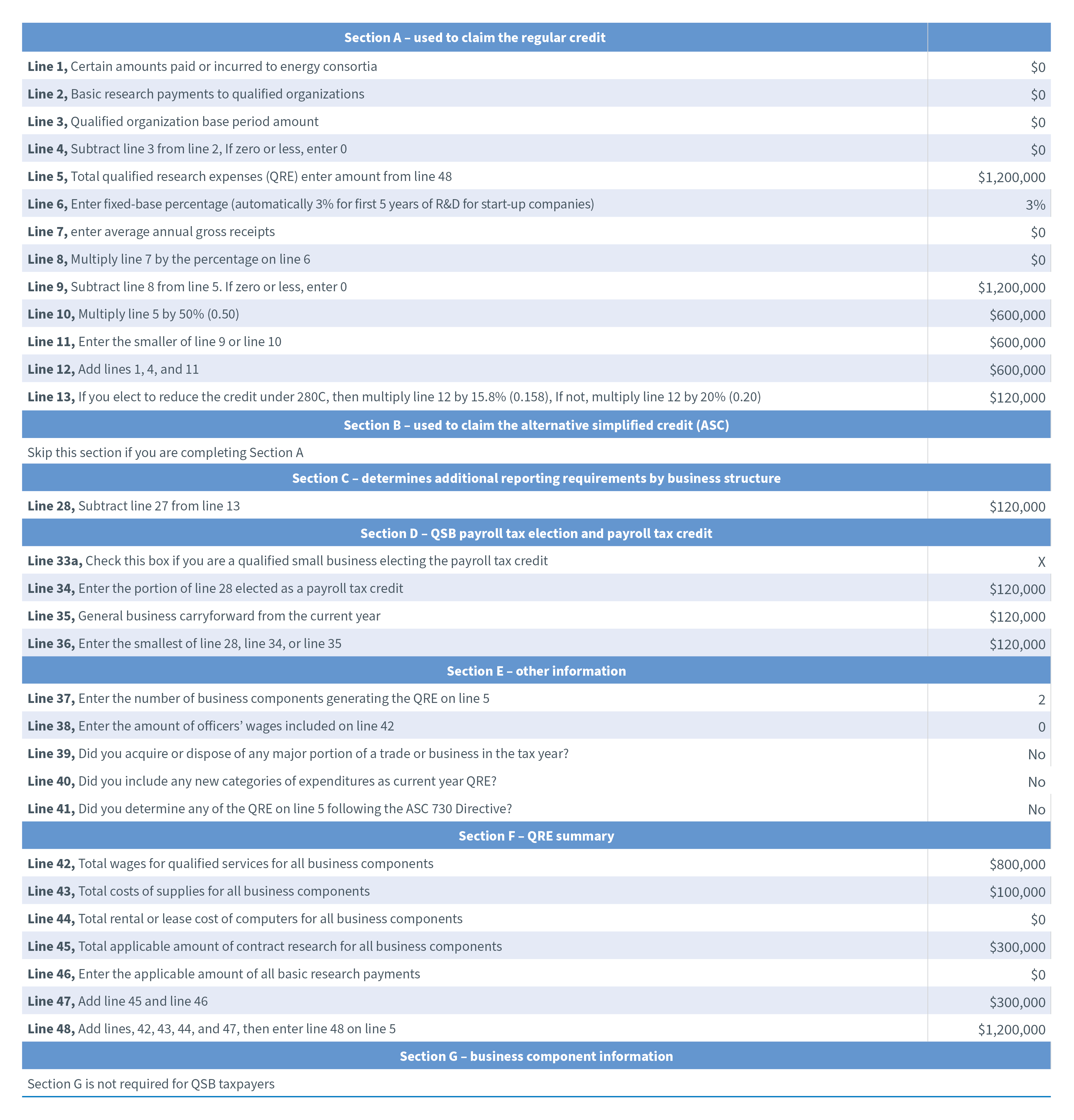

A life sciences startup (the Company), specializing in biomedical research and pharmacology, raised capital and began operations in 2024. The Company’s qualifying projects are focused on developing novel drugs, and it incurs $1.2 million in qualified R&D expenses in 2025 in the following categories:

- Qualified wages from 14 qualified employees conducting direct qualified research

- Lab and preclinical material expenses

- Qualified testing, assay/compound composition, and research assistance from domestic third parties

After completing an R&D tax credit study, the Company claims federal R&D tax credits of $120,000 utilizing the Regular Credit calculation method and files its income tax return on Oct. 10, 2025. The Company meets the QSB requirements listed above and elects to utilize the R&D credit to offset payroll taxes on its income tax return. The Company first utilizes the payroll credit in the first quarter of 2026 with excess credits carrying over to subsequent quarters.

When preparing IRS Form 6765, the Company calculates the credit utilizing the following amounts.

Per Draft Form 6765 (Rev. December 2024)

What does CohnReznick think?

The IRA has incentivized taxpayers, more than ever, to spend on research and development. Life sciences companies should review their tax position with a trusted provider to remain compliant with these updates and determine the appropriate way to utilize credits to maximize tax savings.

Contact

Let’s start a conversation about your company’s strategic goals and vision for the future.

Please fill all required fields*

Please verify your information and check to see if all require fields have been filled in.

Related services

Any advice contained in this communication, including attachments and enclosures, is not intended as a thorough, in-depth analysis of specific issues. Nor is it sufficient to avoid tax-related penalties. This has been prepared for information purposes and general guidance only and does not constitute legal or professional advice. You should not act upon the information contained in this publication without obtaining specific professional advice specific to, among other things, your individual facts, circumstances and jurisdiction. No representation or warranty (express or implied) is made as to the accuracy or completeness of the information contained in this publication, and CohnReznick, its partners, employees and agents accept no liability, and disclaim all responsibility, for the consequences of you or anyone else acting, or refraining to act, in reliance on the information contained in this publication or for any decision based on it.