Our solutions are tailored to each client’s strategic business drivers, technologies, corporate structure, and culture.

HUD Updates FHA Multifamily Rules to Boost Supply, Affordability

Policy changes to FHA's Multifamily Housing Programs aim to boost supply and support affordability amid changing market conditions.

In recent months, the U.S. Department of Housing and Urban Development (HUD) has issued a number of draft and finalized policy changes related to the Federal Housing Administration's (FHA) Multifamily Housing Programs' underwriting standards and guidelines. Amidst changing market conditions and a prolonged period of elevated interest rates since 2022, these changes aim to stimulate production and boost multifamily housing supply of both market rate and affordable units, while also supporting long-term affordability of properties financed with the Low-Income Housing Tax Credit (LIHTC).

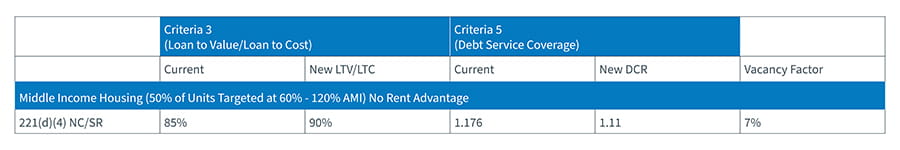

Creating a Middle Income Housing option for 221(d)(4)

Following the release of a draft Mortgagee Letter in October 2024, HUD issued Mortgagee Letter 2025-02 on Jan. 8, 2025, proposing new underwriting standards for Middle Income Housing, defined as units targeting 60% to 120% area median income (AMI). The underwriting guidelines would be instituted under the provision of the Multifamily Accelerated Processing (MAP) Guide. All targeted units would be secured by a deed restriction and monitored by a state or local government entity annually. However, it is currently unclear which governmental entities will be responsible for this monitoring.

The current and new MAP underwriting requirements presented in the Mortgagee Letter are summarized in the table below:

Similar to the draft Mortgagee Letter adjusting Debt Service Coverage Ratios (DSCR) and Loan to Value/Loan to Cost (LTV/LTC) ratios for MAP loans, Middle Income Housing underwriting standards may necessitate that lenders update their underwriting models and Quality Control Plans. We note that at this time, it is unclear if the 50% of units that are not restricted to middle income housing would be market rate, affordable, or some combination of the two.

The new Middle Income Housing underwriting standards may provide broader access to financing for LIHTC projects using the average income minimum set-aside, with AMI restrictions ranging from 20% to 80% (in 10% increments). If 50% or more of the units are restricted between 60% and 80% AMI, the project could qualify for the favorable Middle Income Housing underwriting standards. Additionally, these standards should integrate well with state and local workforce housing initiatives, many of which provide additional financing opportunities and benefits to developers that restrict units up to 120% of AMI. By utilizing Middle Income Housing, developers can create mixed-income communities offering affordable options across a wider income spectrum.

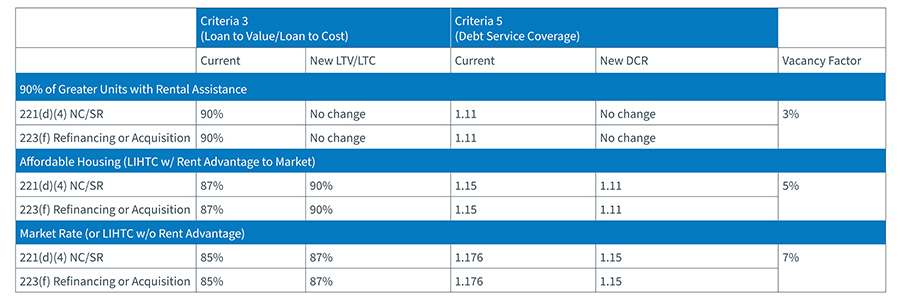

Multifamily changes in DSCR and LTV/LTC ratios

Additionally, HUD issued another draft Mortgagee Letter in October 2024, which was officially published as Mortgagee Letter 2025-03 on Jan. 8, 2025, updating the underwriting standards and guidelines for FHA’s Multifamily Housing programs under the provisions of the MAP program. Adjustments have been made to ease DSCR requirements to finance more multifamily housing developments. LTV/LTC ratios have been revised to allow higher loan amounts relative to the value or cost of the property, making financing more feasible for multifamily lenders. The Mortgagee Letter notes that there is no change to the current LTV ratio for cash out refinancing under Section 223(f), and there is no proposed change in the current vacancy factor underwriting.

The new underwriting guidelines will be implemented immediately for any application that has not reached initial endorsement. The changes are not applicable to the health care programs administered by the Office of Healthcare Programs (Section 232 or refinancing of Section 232 pursuant to Sections 223 (f) or 223 (a) (7)), nor does it apply to Risk Share (542) loans.

The current and new MAP underwriting requirements presented in the Mortgagee Letter are summarized in the table below:

The guideline changes should stimulate multifamily housing construction and renovation, though they may require more careful risk assessment. Lenders will need to reassess risk profiles and adjust underwriting guidelines, including Quality Control Plans. For affordable housing developers, the new DSCR and LTV ratios should make financing more accessible and expand project eligibility, especially in capital constrained rural and very-low-income markets. Ultimately, the new DSCR and LTV ratios will need to be approved by other financing partners in the capital stack, including allocating housing finance agencies (HFA). Most state HFAs have exited the MAP lending space, with only one remaining as of 2024. The changes could encourage state HFAs to resume lending, particularly for preserving affordable housing at distressed properties with limited financing options.

LIHTC equity investors and syndicators can expect new opportunities due to higher leverage allowances, but these may necessitate waiving or mitigating investment standards, which typically require a minimum 1.15-1.20 DSCR for most LIHTC projects. As the LIHTC industry contends with absorbing increased operating costs, including insurance and utilities, flexibility in lending parameters is likely to be welcomed to the extent they can be tolerated by investors.

New guidance on the horizon

Lastly, HUD issued a draft Housing Notice introducing new guidance addressing the Qualified Contract (QC) provision in the LIHTC program. The QC provision allows developers to exit affordability requirements after the LIHTC program’s initial 15-year compliance period, converting the property to market rate. The draft notice would require any LIHTC project seeking to participate in FHA Multifamily Rental and Risk Share programs to waive the QC provision as a condition of financing. Most immediately, this guidance would apply to FHA multifamily rental projects for which a firm commitment has not been issued and Risk Share insurance transactions with Firm Approval Letters (FALs) issued on or after a certain date, which will be updated once the final Housing Notice is published.

By requiring waivers of the QC provision, HUD is proactively taking steps to preserve the long-term affordability of LIHTC developments beyond the initial compliance period. Typically, most LIHTC affordability restriction periods consist of a 15-year compliance period and a 15-year extended-use period subject to a deed restriction. HUD’s draft notice aims to help ensure LIHTC properties financed under FHA Multifamily Rental and Risk Share programs remain affordable for the 30-year extended use period. HUD encouraged developers to review the draft notice and submit feedback by Sept. 20, 2024, to influence the final implementation of this policy, which is expected to go into effect in 2025.

According to the notice, based on publicly available data through the National Housing Trust, nearly 40 HFAs currently require some form of a QC waiver as a condition of receiving a LIHTC allocation. QC waivers vary by state and not all require a waiver of the full 15-year extended use period. The draft HUD notice would require an unconditional waiver of the right to request a QC within LIHTC allocation documents and require the owner to affirmatively agree to maintain the project as affordable housing for the initial 30-year period. It is not clear from the draft HUD notice how the waiver will be documented or if the waiver would be co-terminus with the mortgage. It was noted that the details regarding documentation of the waivers were still being finalized.

As the largest and most crucial program for creating and rehabilitating affordable housing in the United States, the LIHTC program relies heavily on FHA financing. According to data published by HUD’s Office of Multifamily Housing Production and Office of Healthcare Programs, LIHTC projects have accounted for more than 27% of all multifamily and Section 232 healthcare projects financed with FHA loans since fiscal year 2020. Since fiscal year 2020, more than 1,250 LIHTC developments have secured more than $18.7 billion in FHA financing. These figures include a handful of Section 232 healthcare loans with LIHTC; further clarification is required from HUD as to whether future production will be subject to the QC waiver as well.

Additionally, the proportion of FHA-financed projects utilizing LIHTCs has steadily increased. In fiscal year 2020, approximately 24% of FHA-financed projects were LIHTC projects. This figure rose to nearly 30% in fiscal year 2023 and almost 43% in fiscal year 2024. The QC waiver requirement will safeguard LIHTC developments receiving favorable terms under FHA financing programs remain affordable beyond the initial 15-year LIHTC compliance period.

What does CohnReznick think?

The recent updates to FHA’s MAP program, including the introduction of Middle Income Housing underwriting standards and the rollback of LTV and DSCR ratios, benefits developers, lenders, and investors by providing more flexible multifamily financing options, promoting the creation of mixed-income communities, and preserving affordable housing units. Lenders will need to update their financial models, due diligence requirements, and Quality Control Plans to memorialize these new FHA underwriting standards.

Notably, more than 4,700 LIHTC projects received nearly $48 billion in FHA financing between federal fiscal years 2001 and 2024. Given the representation of FHA risk sharing programs in the LIHTC industry, it is beneficial to have the programmatic requirements and underwriting standards of Section 42 and FHA’s Multifamily Housing programs be aligned to make the access to and deployment of capital efficient. More synergies and efficiencies between the two programs help address the critical need for affordable housing and support the creation and long-term preservation of these vibrant and diverse communities across the nation.

Mortgagee Letter 2025-02 and Mortgagee Letter 2025-03 are effective immediately and will remain effective until amended, superseded, or rescinded. MAP Guide Chapter 3 will also be revised to incorporate the changes specified in the Mortgagee Letters. The draft Housing Notice regarding QC waivers was expected to be effective as of Dec. 31, 2024; however, it had not been published by the release date of this article. Additionally, readers should stay informed about potential developments under the incoming administration that may impact these guidelines. As more projects adopt these new guidelines, it is likely that the underwriting standards and other applicable MAP Guide provisions will be further refined, warranting close attention.

CohnReznick’s Project Finance and Consulting practice offers project-level financial modeling, due diligence, and exit strategy analysis to support multifamily transactions. Our compliance team makes sure investor, lender, and government requirements are met. We conduct annual quality control reviews for licensed multifamily and residential mortgage lenders under FHA’s MAP and Section 232 (Lean) programs. These reviews evaluate lenders' quality control plans and provide independent assessments of their origination, underwriting, closing, construction loan administration, and loan servicing processes against program rules. Additionally, we assist with MAP and Lean certification and review loan defaults when necessary. CohnReznick serves nearly half of all MAP and Lean lenders, covering over $3.5 billion in loan commitments in 2023.

Contact

Let’s start a conversation about your company’s strategic goals and vision for the future.

Please fill all required fields*

Please verify your information and check to see if all require fields have been filled in.

Related services

Any advice contained in this communication, including attachments and enclosures, is not intended as a thorough, in-depth analysis of specific issues. Nor is it sufficient to avoid tax-related penalties. This has been prepared for information purposes and general guidance only and does not constitute legal or professional advice. You should not act upon the information contained in this publication without obtaining specific professional advice specific to, among other things, your individual facts, circumstances and jurisdiction. No representation or warranty (express or implied) is made as to the accuracy or completeness of the information contained in this publication, and CohnReznick, its partners, employees and agents accept no liability, and disclaim all responsibility, for the consequences of you or anyone else acting, or refraining to act, in reliance on the information contained in this publication or for any decision based on it.