Repowering: Critical financing considerations for retrofitting wind and solar energy property

Repowering offers developers the opportunity to commercially revitalize older wind and solar farms whose equipment has undergone considerate wear and tear over the years.

The transition of the U.S. from fossil fuels to renewable energy and green electrification has been remarkable since the installation of the first 1MW solar farm in 1982 in Hesperia, CA. In the past four decades, the U.S. has expanded capacity, advanced technology, and diversified sources across all scales of energy adoption from residential and community DG solar to utility scale wind, solar, and storage. According to the U.S. Energy Information Administration (EIA), renewable energy now provides more than 21% of total U.S. utility-scale electricity generation, as noted by EIA in their 2023 Electric Power Annual Report. However, the expansion and growth of the renewable energy industry was not accomplished by merely adding capacity via greenfield projects, but also through repowering existing operational projects.

Repowering is the combined process of dismantling and upgrading existing energy generation projects to restore and bolster performance with new technology and equipment. With proper incentives and the careful application of technical tax credit rules, repowering offers developers the opportunity to commercially revitalize older wind and solar farms whose equipment has undergone considerate wear and tear over the years while generating new federal income tax credits that can be monetized to help finance the repowering.

Wind repowering

Wind repowering may offer appealing returns to developers and investors as compared to greenfield installations. Greenfield development has declined in recent years due to rising capital costs, limited interconnection opportunities, and dwindling ground space near grid connection points. Fortunately, according to Enverus Intelligence Research, the repowering process could cost 50% to 80% less than a new installation, with the primary source of savings coming from utilizing an existing grid interconnection. Yet, the savings are not only in terms of dollars but also in terms of time, as interconnection queue times have extended significantly. According to the Lawrence Berkeley National Laboratory, the typical duration from connection request to commercial operation increased from less than two years for projects built in 2000-2007 to over four years for those built in 2018-2023. Projects built in 2023 were expected to undergo a median queue time of five years. The time value of money difference in comparing entering a greenfield project into a four-year interconnection queue versus utilizing an existing interconnection is substantial.

Production Tax Credit (PTC) and the “80/20 Rule”

A critical source of investment returns for repowered wind projects is the qualification for Production Tax Credit (PTC) which is a per-kilowatt-hour federal income tax credit under Section 45 of the U.S. tax code, viable for 10 years beyond the placed in service (or repowered) date. To be eligible for the PTC under repowering, the upgrade project under consideration must pass the so-called “80/20 Rule.” If you qualify for the PTC, you can also elect the ITC but then you must apply the ITC rules, not the PTC rules, for repowering. The 80/20 rule is a test established by the IRS for federal income tax purposes based on fair market value (FMV). Fair market value under the 80/20 test requires the sponsor that intends to make the project eligible for new tax credits to determine whether the project has been extensively rebuilt to such an extent that it may be considered placed in service as “new” for federal tax purposes, even though some portion of the entire project has used equipment still in use. More specifically, IRS Notice 2016-31 states that “[a] facility may qualify as originally placed in service even though it contains some used property, provided the FMV of the used property is not more than 20 percent of the facility’s total value (the cost of the new property plus the FMV of the used property).” Said differently, the cost of the new equipment being installed should be at least quadruple the FMV of the old components that is being re-used to make up the repowered project.

Additional IRS guidance in the form of Revenue Ruling 94-31 defines “individual wind turbines and functioning components, together with their respective towers and supporting pads” as the “facility.”

The 80/20 rule and related tax qualifications have sparked increased interest in repowering, particularly for wind farms. According to the Department of Energy’s Land Based Wind Market Report: 2023 Edition, 1.7 GW of existing wind plants were partially repowered in 2022, and most of the upgrades were applied for rotors and nacelle components such as gear boxes and generators. Moreover, there is still ample room for repowering opportunities: Based on data by the Department of Energy, between 1999 and 2015, there was over 473 GW of installed wind turbines, most of which are located in California, Minnesota, and Texas.

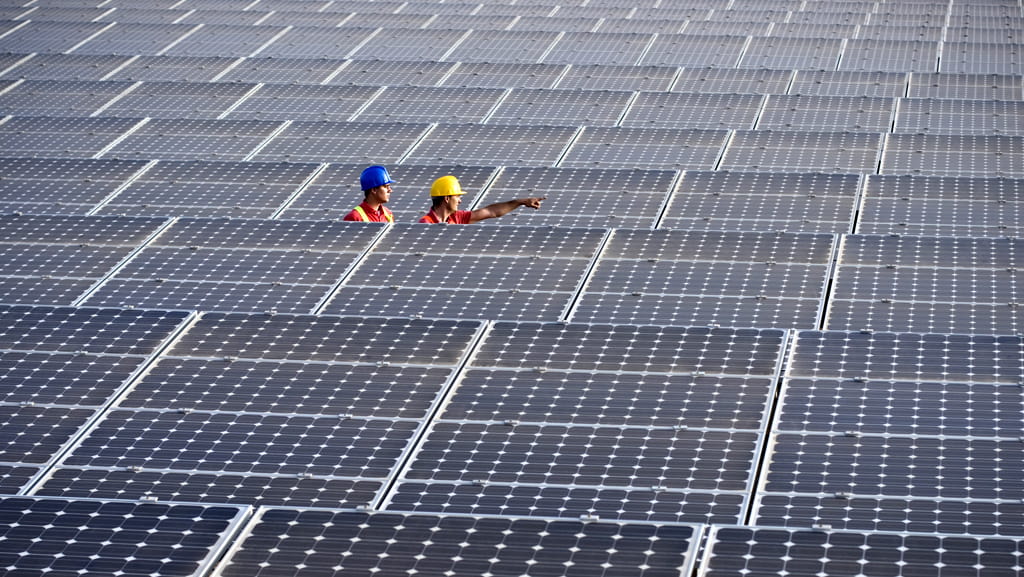

Solar repowering

Most of current repowering efforts are focused on wind farms but retrofitting solar photovoltaic (PV) systems are also garnering interest. Many PV projects are undergoing the need for replacing components, especially given the greater efficiency of newer solar panels and the fact that inverters (which have an average normal useful life of 15 years) are in need of replacement. According to projections by Wood Mackenzie, approximately 23 GW of U.S. solar – across residential, commercial, and utility scales – will approach this 15-year benchmark within the next five years. This means an average of 4.5 GW of PV projects will need new inverters every year until 2030. Meanwhile, the PV panels and balance of plant have various useful lives with an average of 35 years.

Investment Tax Credit (ITC) and the “80/20 Rule”

As the benefits of repowering solar are increasingly apparent, the cost-saving aspect of utilizing an existing interconnection as discussed earlier can also be applied here. The U.S. Treasury has recently acknowledged this. In November 2023, the U.S. Treasury and the IRS issued proposed regulations related to the section 48 ITC and its definition of “energy property”, to include the application of the “80/20” rule to property eligible for the ITC, which, assuming other technical requirements are met, is generally at least a 30% federal tax credit for developing solar systems, and which can be calculated based on the FMV of the system.

While the newly proposed ITC regulations (which have not been finalized as of the date of this article) clearly appear to encourage repowering of ITC eligible projects, the proposed rules are not without some controversy. For example, an important consideration is that the “80/20” test, according to the proposed regulations, applies to a “unit of energy property," which is defined in the regulation as "all functionally interdependent components that are operated together and can operate apart from other energy properties within a larger energy project.” In the scope of a solar PV system, there can be multiple interpretations, and segregations of a so-called “unit of energy property.” For example, the whole system containing PV modules, inverters and balance of plant could be considered one unit of energy property. At the same time, smaller units of such large systems, or even each PV module with string inverters can sometimes be viewed as independent and operating separately as a smaller project. Overall, there needs to be further elaboration of the proposed regulations so that repowering costs and incentives could be better estimated.

Conclusion

There are many themes to consider in the realm of wind solar and solar repowering in the context of the current economic and regulatory environment when contemplating the next step for your aging renewable power asset. The introduction and extending of the proposed regulations for application of the 80/20 with the ITC rule has materialized to incentives for the repowering effort with both the PTC and ITC. Nonetheless, a recurring focus on FMV – be it of retained components, new equipment, the “as-upgraded” project, a whole system, or a singular unit of energy property – necessitates for assistance from experienced appraisers and valuers.

An appraisal will consider the three traditional approaches to value when opining on the FMV: Cost Approach, Income Approach, Market Approach. The indications of value derived from these three approaches are synthesized to conclude on the FMV. An experienced appraiser will also be able to develop a robust fixed asset register based on available records and other public and private data. This helps to “carve up” the reused components value from the facility value.

The appraiser needs to understand the repowering process from an engineering, legal, and financial perspective especially when regulations are continuously proposed and updated with guidance. Scrutiny of the appraisal process is warranted from different stakeholders, including but not limited to tax-equity investors, lenders, and regulatory bodies such as the IRS.

Joo Sang Chae

Contact

Let’s start a conversation about your company’s strategic goals and vision for the future.

Please fill all required fields*

Please verify your information and check to see if all require fields have been filled in.

Related services

Our solutions are tailored to each client’s strategic business drivers, technologies, corporate structure, and culture.

This has been prepared for information purposes and general guidance only and does not constitute legal or professional advice. You should not act upon the information contained in this publication without obtaining specific professional advice. No representation or warranty (express or implied) is made as to the accuracy or completeness of the information contained in this publication, and CohnReznick, its partners, employees and agents accept no liability, and disclaim all responsibility, for the consequences of you or anyone else acting, or refraining to act, in reliance on the information contained in this publication or for any decision based on it.